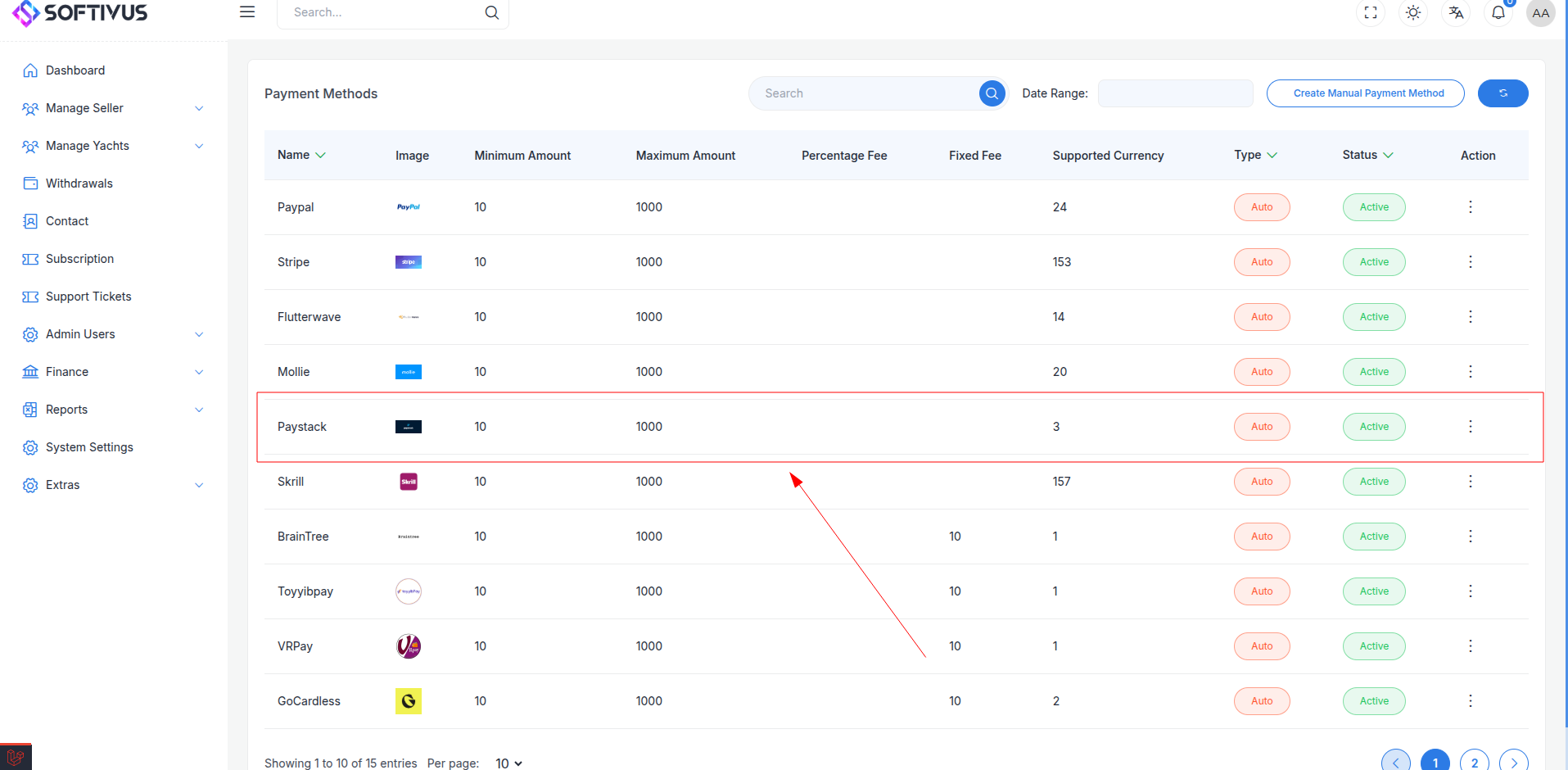

Paystack Payment Gateway Integration

Paystack is a leading payment gateway focused on Africa, enabling businesses in countries like Nigeria, Ghana, Kenya, and South Africa to accept payments seamlessly. It supports a variety of payment methods, including credit/debit cards, bank accounts, mobile money, USSD, and QR codes, with a modern API designed for developers. Paystack is ideal for businesses looking to process local and international transactions with high success rates and robust fraud protection.

This guide provides a step-by-step process to integrate Paystack into your application, from account creation to live deployment.

Step 1: Log in or Sign Up

- Visit Paystack: Go to Paystack and click Sign Up to create a new account or Log In if you already have one.

- Account Creation: Enter your email, password, and basic business details (e.g., name, country). Paystack supports both individual and business accounts.

- Email Verification: Check your inbox for a verification email from Paystack and click the link to confirm your account.

- Dashboard Access: After verification, log in to access the Paystack Dashboard, where you’ll manage payments, settings, and API keys.

Step 2: Set Up Your Account

Before processing payments, configure your Paystack account:

-

Complete Your Profile:

- In the Paystack Dashboard, go to Settings > Business.

- Provide your business details: legal name, address, phone number, and website URL (optional for test mode).

- For individuals, enter personal details like name and contact information.

-

Business Verification (Required for Live Mode):

- Paystack requires verification to process real payments. Navigate to Settings > Business > KYC.

- Submit documents based on your country (e.g., Nigeria: CAC certificate, bank account details; Ghana: business registration).

- Verification typically takes 1-3 business days. You’ll receive an email once approved.

-

Add a Settlement Bank:

- Go to Settings > Bank Accounts.

- Enter your bank details (e.g., IBAN for international or local account number) for payouts.

- Paystack may send a small test deposit to verify the account.

-

Test Mode: Until verified, you can use Test Mode to simulate transactions without restrictions.

Step 3: Obtain API Credentials

Paystack provides API keys for integration:

- Public Key: Used in client-side code (e.g., checkout forms).

- Secret Key: Used in server-side code for secure API calls.

- Test vs. Live: Test keys (prefixed with

pk_test_orsk_test_) are for development; Live keys (prefixed withpk_live_orsk_live_) are for production.

How to Get Your Credentials:

- In the Paystack Dashboard, go to Settings > API Keys & Webhooks.

- You’ll see:

- Test Public Key and Test Secret Key: Available immediately for testing.

- Live Public Key and Live Secret Key: Available after business verification.

- Key Security: Keep the Secret Key confidential—never expose it in client-side code. Copy both keys and store them securely.

- Add these to your application’s Admin Panel under System Settings > Payment Gateways > Paystack.

Step 4: Configure Payment Methods

Paystack supports multiple payment channels, which are enabled by default or upon request:

- Go to Settings > Payment Channels in the Paystack Dashboard.

- Available methods include:

- Cards: Visa, MasterCard, Verve (enabled by default).

- Bank Accounts: Direct bank payments (Nigeria-specific).

- Mobile Money: Popular in Ghana and Kenya (request activation if needed).

- USSD: For Nigerian customers (enabled by default).

- QR Codes: For in-person or mobile payments (request activation).

- Contact Paystack support via support@paystack.com to enable additional methods not visible in your dashboard.

- These methods will appear in your checkout flow once integrated.

Step 5: Set Up Webhooks

Webhooks notify your server of payment events (e.g., successful transactions):

- In the Paystack Dashboard, go to Settings > API Keys & Webhooks.

- Scroll to the Webhook URL section and click Edit.

- Webhook URL:

- Enter the URL from your application (e.g.,

https://yourwebsite.com/webhooks/paystack). - Find this URL in your Admin Panel under Paystack settings.

- Ensure your endpoint accepts POST requests and returns a 200 OK response.

- Enter the URL from your application (e.g.,

- Events: Paystack sends events like

charge.success(payment completed) orcharge.failed(payment failed). You don’t need to select events manually—all relevant updates are sent. - Click Save Changes.

- Test Webhook: Use the Send Test Webhook button to verify your endpoint works.

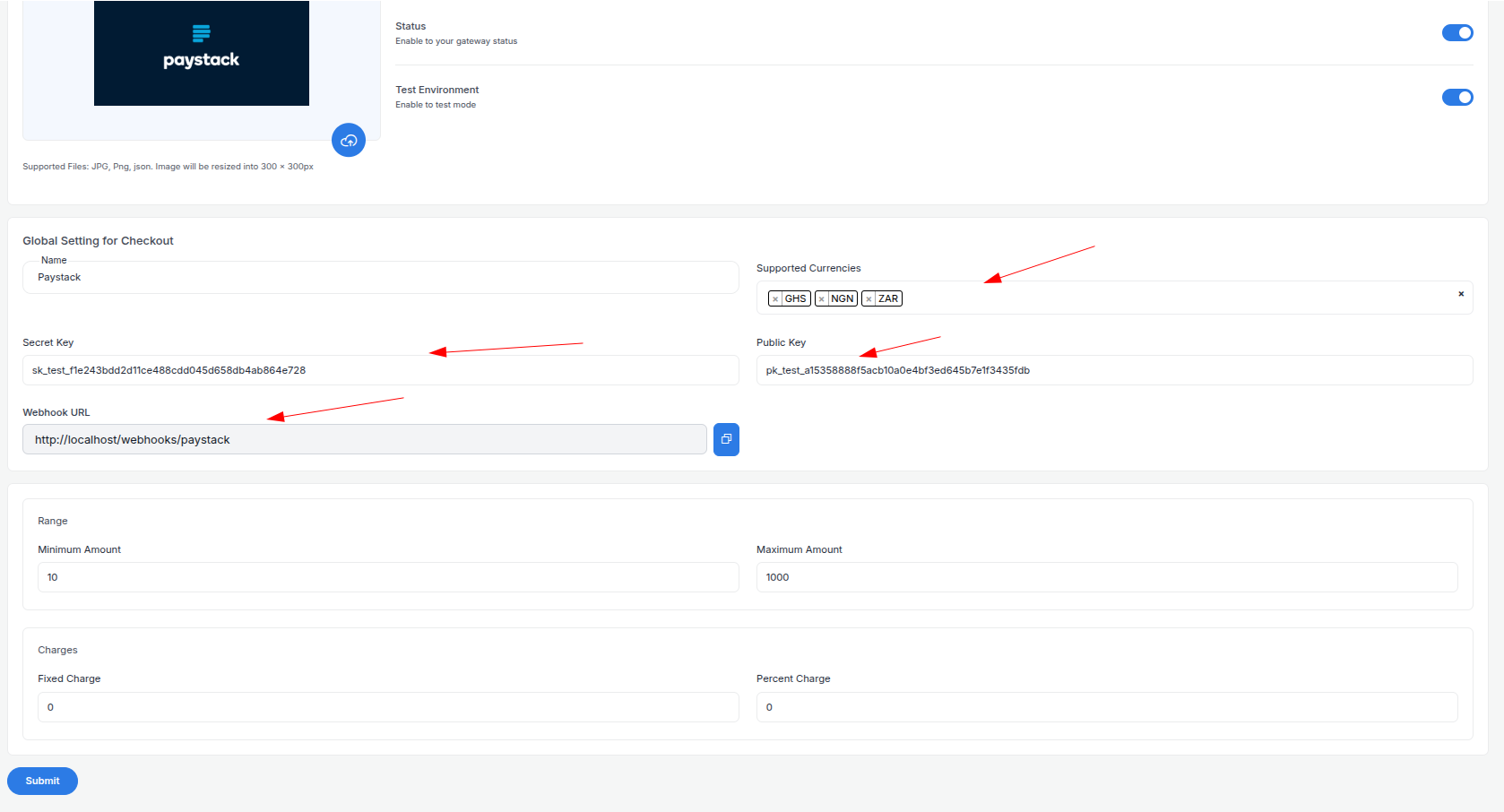

Step 6: Set Up Credentials in Our Dashboard

Integrate Paystack into your application:

- Log in to your application’s Admin Panel.

- Navigate to System Settings > Payment Gateways > Paystack.

- Fill out the configuration form:

-

Detailed Fields:

- Supported Currencies: Select currencies (e.g., NGN, GHS, USD, ZAR) enabled on your Paystack account. Contact Paystack to enable USD or others if needed.

- Active: Toggle “On” to enable Paystack payments.

- Live Mode: Toggle “Off” for testing, “On” for live transactions.

- Public Key: Enter your Test Public Key (e.g.,

pk_test_abc123) or Live Public Key (e.g.,pk_live_xyz789). - Secret Key: Enter your Test Secret Key (e.g.,

sk_test_def456) or Live Secret Key (e.g.,sk_live_ghi789). - Webhook URL: Copy this URL and paste it into the Paystack Dashboard’s webhook settings.

- Minimum Amount: Set a floor (e.g., ₦100) to avoid small transactions.

- Maximum Amount: Set a ceiling (e.g., ₦1,000,000) based on your needs.

- Fixed Charge: Add a flat fee (e.g., ₦50) per transaction, if applicable.

- Percentage Charge: Add a percentage fee (e.g., 1.5%) on top of Paystack’s fees.

-

Click Submit to save. Your Paystack gateway is now configured.

Step 7: Test the Integration

Test your setup in Test Mode:

- Enable Test Mode:

- In your Admin Panel, ensure Live Mode is off and use the Test Public Key and Test Secret Key.

- In the Paystack Dashboard, confirm you’re using test credentials.

- Simulate Payments:

- Use Paystack’s test cards:

- Success:

408 408 408 408 408 1, expiry12/25, CVV408, PIN1234. - Failure:

5399 8383 1234 5678, expiry12/25, CVV123.

- Success:

- Test other methods like USSD (

*737#) or bank transfers with test credentials.

- Use Paystack’s test cards:

- Verify Webhooks:

- Check your server logs for webhook events (e.g.,

charge.success). - Ensure payment statuses update in your Admin Panel (e.g., “Paid,” “Pending”).

- Check your server logs for webhook events (e.g.,

- Debugging: If issues arise, check the Paystack Dashboard’s Transactions tab for error details (e.g., “Card Declined”).

Step 8: Enable Live Mode

After successful testing:

- Paystack Dashboard:

- Ensure your account is verified and you have the Live Public Key and Live Secret Key.

- Admin Panel:

- Go to System Settings > Payment Gateways > Paystack.

- Toggle Live Mode to “On”.

- Replace the test keys with the Live Public Key and Live Secret Key.

- Save the changes.

- Webhook Confirmation: Verify the webhook URL is still set correctly in the Paystack Dashboard.

Step 9: Go Live

Launch your Paystack integration:

- Start Accepting Payments:

- Customers can now pay using enabled methods at checkout.

- Monitor initial transactions for any issues.

- Live Verification:

- In the Paystack Dashboard, go to Transactions to track payments in real-time.

- Confirm payouts to your bank account (daily or weekly, depending on settings).

- Troubleshooting:

- If payments fail, review error logs in the Paystack Dashboard or contact support@paystack.com.

- Ensure your webhook endpoint remains operational.

Additional Tips

- Paystack Fees: Paystack charges per transaction (e.g., 1.5% + ₦100 for local cards in Nigeria, capped at ₦2000). Check pricing and adjust your charges accordingly.

- Documentation: Explore the Paystack Developer Docs for advanced features like recurring payments or split payments.

- Support: Reach out to Paystack via support@paystack.com or the Dashboard’s live chat for assistance.

Note:

If you encounter any issues or need further help, our support team is available. Contact us at softivus@gmail.com or through the Admin Panel. Let’s get your Paystack integration up and running smoothly!