Square Payment Gateway Integration

Square is a comprehensive payment platform that simplifies accepting payments online, in-person, and via mobile apps. Operating in countries like the USA, Canada, UK, Australia, Japan, Ireland, France, and Spain, Square supports major credit/debit cards (Visa, MasterCard, AmEx, Discover), digital wallets (Apple Pay, Google Pay, Cash App), and ACH payments (US-only). Unlike traditional gateways, Square acts as an end-to-end processor, eliminating the need for a separate merchant account. With features like customizable checkouts, recurring payments, and PCI compliance built-in, Square is ideal for businesses seeking a unified solution across channels.

This guide walks you through integrating Square into your application, from account setup to live deployment.

Step 1: Log in or Sign Up

- Visit Square: Go to Square and click Sign Up to create a merchant account or Log In if you have one.

- Account Creation: Provide your email, password, and business details (e.g., name, country, industry). No separate merchant account is needed—Square handles this.

- Email Verification: Check your inbox for a verification email from Square and click the link to activate your account.

- Dashboard Access: Log in to the Square Dashboard at squareup.com/dashboard. You’ll automatically get Sandbox access for testing.

Step 2: Set Up Your Account

Before processing payments, configure your Square account:

-

Complete Your Profile:

- In the Dashboard, go to Account & Settings > Business Information.

- Enter your business details: legal name, address, phone number, and website URL (optional for testing).

- For individuals, provide personal details.

-

Business Verification (Required for Live Mode):

- Navigate to Account & Settings > Verification.

- Submit documents like a business license, ID, or tax ID (varies by country, e.g., EIN for US).

- Verification takes 1-2 business days; you’ll be notified via email.

-

Add a Bank Account:

- Go to Account & Settings > Bank Accounts.

- Link your bank (e.g., routing/account number for US, IBAN for Europe) for payouts. Square deposits funds in 1-2 business days (or instantly for a 1% fee).

- Verify with a test deposit if prompted.

-

Sandbox Mode: Use the Sandbox at developer.squareup.com with test credentials to simulate payments without verification.

Step 3: Obtain API Credentials

Square provides credentials for integration:

- Application ID: Identifies your app (e.g.,

sq0idp-abc123xyz). - Access Token: Authenticates API requests (e.g.,

EAAAE_xyz789abcfor live,sandbox-sq0atb-def456ghifor test). - Location ID: Specifies the business location for transactions (e.g.,

L1234567890).

How to Get Your Credentials:

- Log in to the Square Developer Portal at developer.squareup.com.

- Go to Applications and click Create Application.

- Name your app (e.g., "MyStoreApp") and save:

- Application ID: Displayed immediately.

- Access Token: Generate under Credentials (Sandbox token available instantly; live token post-verification).

- Location ID: Find under Locations after linking a Square account.

- Key Security: Keep the Access Token confidential—use it server-side only. Store all credentials securely.

- Add these to your application’s Admin Panel under System Settings > Payment Gateways > Square.

Step 4: Configure Payment Methods

Square supports various payment methods, enabled by default or via settings:

- Go to Account & Settings > Payments in the Dashboard.

- Available methods include:

- Cards: Visa, MasterCard, AmEx, Discover (enabled by default).

- Digital Wallets: Apple Pay, Google Pay, Cash App (enable via API or hardware).

- ACH: US-only bank transfers (enable via Dashboard or API).

- Contact support@squareup.com to enable additional methods (e.g., Afterpay) or multi-currency support.

- These methods will appear in your checkout flow once integrated.

Step 5: Set Up Webhooks

Webhooks notify your server of payment events (e.g., payment success):

- In the Developer Portal, go to Webhooks.

- Click Add Endpoint.

- Webhook URL:

- Enter the URL from your application (e.g.,

https://yourwebsite.com/webhooks/square). - Find this URL in your Admin Panel under Square settings.

- Ensure your endpoint accepts POST requests and returns a 200 OK response.

- Enter the URL from your application (e.g.,

- Events: Subscribe to events like:

payment.created: Payment initiated.payment.updated: Status changed (e.g., completed, failed).refund.created: Refund processed.

- Save the webhook. Square signs notifications with your Access Token for verification.

- Testing: Use the Sandbox to send test webhooks and confirm receipt.

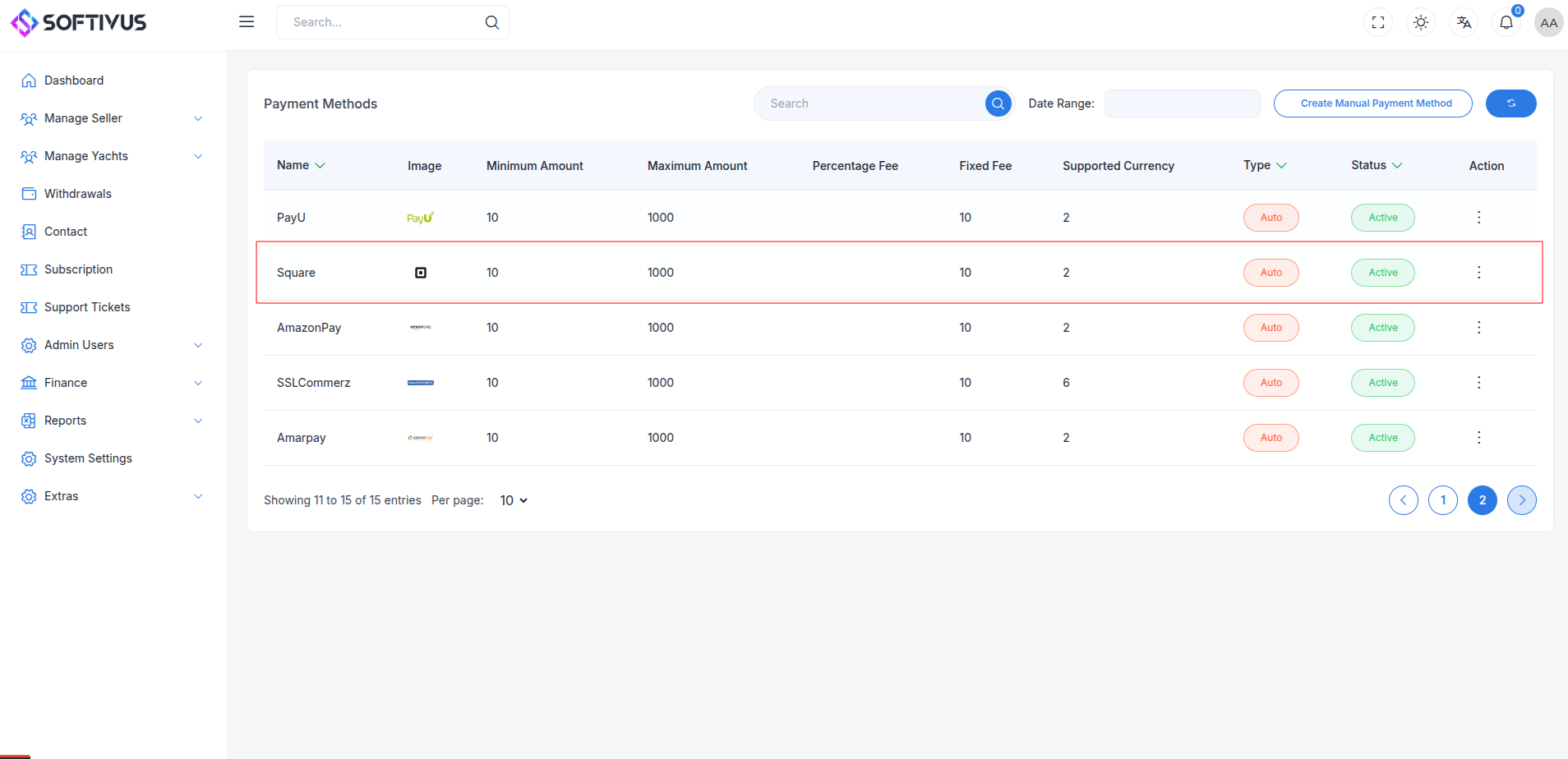

Step 6: Set Up Credentials in Our Dashboard

Integrate Square into your application:

- Log in to your application’s Admin Panel.

- Navigate to System Settings > Payment Gateways > Square.

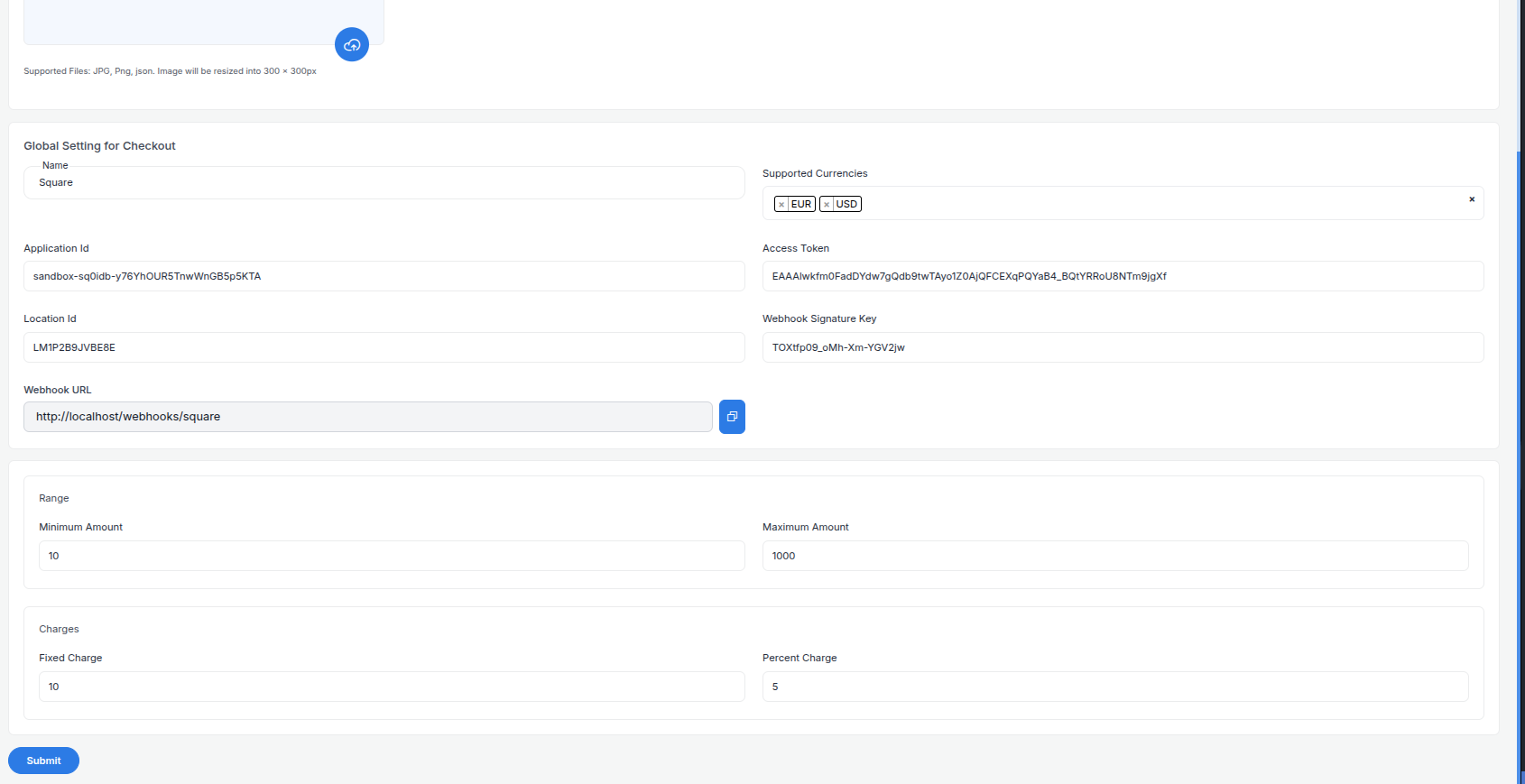

- Fill out the configuration form:

-

Detailed Fields:

- Supported Currencies: Select currencies enabled on your Square account (e.g., USD, GBP, AUD). Each Location ID ties to one currency.

- Active: Toggle “On” to enable Square payments.

- Live Mode: Toggle “Off” for Sandbox, “On” for live transactions.

- Application ID: Enter your Application ID (e.g.,

sq0idp-abc123xyz). - Access Token: Enter your Sandbox or Live Access Token (e.g.,

sandbox-sq0atb-def456ghiorEAAAE_xyz789abc). - Location ID: Enter your Location ID (e.g.,

L1234567890). - Webhook URL: Copy this URL and paste it into the Square Developer Portal’s webhook settings.

- Minimum Amount: Set a floor (e.g., $1.00) per Square’s minimums.

- Maximum Amount: Set a ceiling (e.g., $10,000) based on your needs.

- Fixed Charge: Add a flat fee (e.g., $0.50) per transaction, if applicable.

- Percentage Charge: Add a percentage fee (e.g., 1%) on top of Square’s fees (2.9% + $0.30 online, 2.6% + $0.10 in-person).

-

Click Submit to save. Your Square gateway is now configured.

Step 7: Test the Integration

Test your setup in Sandbox Mode:

- Enable Sandbox Mode:

- In your Admin Panel, ensure Live Mode is off and use Sandbox credentials.

- Access the Sandbox via developer.squareup.com.

- Simulate Payments:

- Use Square’s test cards:

- Success:

4111 1111 1111 1111, expiry12/25, CVV123. - Failure:

4000 0000 0000 0002, expiry12/25, CVV123.

- Success:

- Test ACH or digital wallets with Sandbox flows.

- Use Square’s test cards:

- Verify Webhooks:

- Check your server logs for webhook events (e.g.,

payment.updated). - Ensure payment statuses update in your Admin Panel (e.g., “Paid,” “Failed”).

- Check your server logs for webhook events (e.g.,

- Debugging: If issues occur, check the Sandbox Dashboard’s Payments tab for error codes (e.g., “Card Declined”).

Step 8: Enable Live Mode

After successful testing:

- Square Dashboard:

- Ensure your account is verified and ready for live transactions.

- Log in to squareup.com/dashboard.

- Admin Panel:

- Go to System Settings > Payment Gateways > Square.

- Toggle Live Mode to “On”.

- Replace Sandbox credentials with live Application ID, Access Token, and Location ID.

- Save the changes.

- Webhook Confirmation: Verify the webhook URL is set in the live Developer Portal.

Step 9: Go Live

Launch your Square integration:

- Start Accepting Payments:

- Customers can now pay via enabled methods at checkout.

- Monitor initial transactions for issues.

- Live Verification:

- In the Dashboard, go to Payments to track transactions in real-time.

- Confirm deposits to your bank account (1-2 business days, or instant for 1% fee).

- Troubleshooting:

- If payments fail, review error logs in the Dashboard or contact support@squareup.com.

- Ensure your webhook endpoint remains active.

Additional Tips

- Square Fees: 2.9% + $0.30 for online/card-not-present, 2.6% + $0.10 for in-person (swiped/tapped). No monthly fees. See pricing.

- Documentation: Explore the Square Developer Docs for APIs like Web Payments SDK, Subscriptions, or Checkout API.

- Support: Contact support@squareup.com or use the Dashboard’s live chat for help.

Note:

If you need further assistance, our support team is available 24/7. Reach out at softivus@gmail.com or through the Admin Panel. Let’s get your Square payments up and running smoothly!